Introduction Of Comparing Net Worth: East Coast vs West Coast

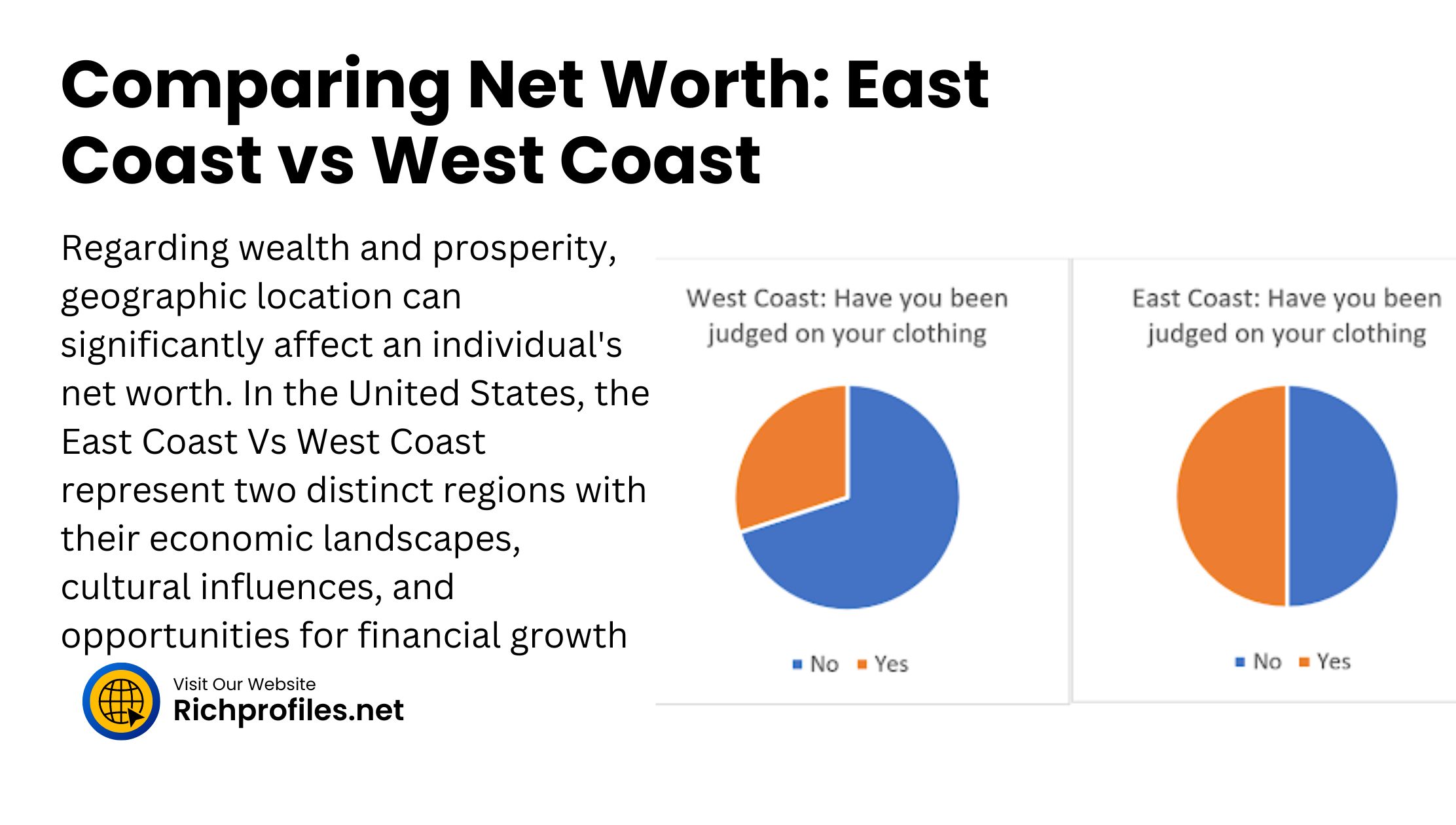

Regarding wealth and prosperity, geographic location can significantly affect an individual’s net worth. In the United States, the East Coast Vs West Coast represent two distinct regions with their economic landscapes, cultural influences, and opportunities for financial growth. This article will delve into the intricacies of net worth comparison between the East Coast and West Coast, examining various factors contributing to wealth accumulation and financial well-being.

Understanding Net Worth

Before diving into the comparison, it’s essential to grasp the concept of net worth. Net worth is the difference between an individual’s assets and liabilities. Assets include cash and investments in real estate and personal possessions, while liabilities encompass debts and financial obligations. Calculating net worth provides a snapshot of an individual’s economic health and overall wealth.

Factors Influencing Net Worth

Several factors influence an individual’s net worth, including income, expenses, and investments. Higher-income levels generally correlate with higher net worth, provided expenses are kept in check and surplus income is strategically invested.

Income

Income is the primary driver of net worth. Those with higher salaries and multiple income streams have greater potential to accumulate wealth over time. However, it’s not just about how much one earns but also how effectively one manages and grows one’s income.

Expenses

Controlling expenses is crucial for building net worth. Regardless of income level, overspending can quickly erode wealth and hinder financial progress. Budgeting, prioritizing expenses, and living within one’s means are essential strategies for maintaining a healthy financial position.

Investments

Investing wisely is critical to increasing net worth. Whether it’s stocks, real estate, or retirement accounts, strategic investments have the potential to generate passive income and appreciate over time. Diversification and long-term planning are fundamental principles of successful investing.

Read More: Exploring The Net Worth Trends Among Gen Z Influencers

East Coast vs West Coast: A Socio-Economic Perspective

Cost of Living

One significant difference between the East and West Coast is the cost of living. Generally, urban areas on the East Coast, such as New York City and Boston, tend to have higher living expenses than cities on the West Coast, like Los Angeles and San Francisco. Housing, transportation, and everyday essentials often come with a premium price tag on the East Coast, impacting disposable income and savings rates.

Income Disparities

Despite the higher cost of living, the East Coast boasts some of the nation’s wealthiest cities and highest income earners. Financial hubs like New York City and Washington, D.C. offer lucrative career opportunities in finance, law, and government, contributing to higher average incomes and net worth. However, income inequality remains a persistent issue, with disparities between the affluent and the working class.

Investment Opportunities

The East Coast and West Coast offer diverse investment opportunities, albeit with different emphases. The East Coast, particularly New York and Boston, has a strong presence in the finance, real estate, and healthcare sectors. On the other hand, the West Coast, led by Silicon Valley in California, dominates the tech industry, providing ample investment prospects in innovative startups and technology companies.

Celebrity Influence on Net Worth Perception

The media often portrays celebrities’ lifestyles on the East and West Coasts, shaping public perception of wealth and success. Hollywood celebrities and tech moguls contribute to the allure of the West Coast, while Wall Street tycoons and influential figures define the East Coast’s financial landscape. However, it’s essential to differentiate between perceived wealth and actual net worth, as celebrity lifestyles may only sometimes reflect proper financial stability.

Real Estate Market Comparison

The real estate market plays a significant role in determining net worth, as homeownership is a primary source of wealth accumulation for many individuals. While both coasts have vibrant real estate markets, there are notable differences in property values, housing affordability, and market trends. Historically, the West Coast has experienced rapid appreciation in home prices, driven by factors such as tech industry growth and limited housing supply, making it challenging for first-time buyers to enter the market.

Tech Industry Dominance: West Coast Advantage

One of the West Coast’s undeniable advantages is its dominance in the technology sector. Silicon Valley, home to tech giants like Google, Apple, and Facebook, attracts top talent and fosters innovation, creating lucrative opportunities for entrepreneurs and investors. The tech industry’s influence extends beyond economic prosperity, shaping cultural norms and driving societal changes on a global scale.

Cultural Differences and Spending Habits

Cultural differences between the East and West Coast manifest in various aspects, including spending habits and lifestyle choices. With its rich history and traditional values, the East Coast may prioritize stability and legacy-building, whereas the West Coast embraces a more entrepreneurial spirit and appetite for risk-taking. These cultural nuances influence consumer behaviour, investment strategies, and long-term financial planning.

Educational Opportunities and Student Debt

Access to quality education plays a crucial role in shaping future earning potential and net worth. Both coasts boast prestigious universities and educational institutions, attracting students worldwide. However, the rising tuition and student debt burden disproportionately affect individuals’ financial well-being, especially recent graduates entering the job market with significant loan obligations.

Retirement Planning and Long-Term Wealth

Planning for retirement is essential for building long-term wealth and financial security. Retirement accounts, such as 401(k)s and IRAs, offer tax advantages and investment opportunities for individuals to grow their nest egg over time. However, navigating retirement planning can be complex, requiring careful consideration of factors like inflation, healthcare costs, and lifestyle preferences.

Conclusion

In conclusion, comparing net worth between the East Coast and West Coast reveals nuanced differences shaped by socio-economic factors, cultural influences, and regional dynamics. While both coasts offer unique opportunities for wealth accumulation, individuals must navigate challenges such as income inequality, housing affordability, and investment volatility. Building net worth requires strategic planning, financial literacy, and adaptability to thrive in an ever-evolving economic landscape.

FAQs

What are some common misconceptions about net worth?

-

- Net worth is often equated with material possessions or high income, but it’s more about financial assets minus liabilities, reflecting true wealth.

How do cultural differences affect net worth?

-

- Cultural differences influence spending habits, investment strategies, and long-term financial planning, shaping individuals’ net worth trajectories.

Is it easier to build wealth on the East Coast or West Coast?

-

- Both coasts offer unique opportunities and challenges for wealth accumulation, depending on factors like income levels, cost of living, and industry specialization.

What role does education play in determining net worth?

-

- Access to quality education impacts earning potential and career opportunities, influencing individuals’ ability to build net worth over time.

How can individuals improve their net worth regardless of location?

-

- By prioritizing financial literacy, budgeting effectively, investing wisely, and seeking income growth and asset accumulation opportunities.